Key themes for advisers in 2018

Outsourcing will continue to be a strong theme for financial advisers in 2018, James Rainbow has said.

The co-head of UK intermediary for Schroders said: "We have seen a marked move by financial advisers from building their portfolios to outsourcing some or all of their portfolio management activities."

He said this has been the situation for the past four years and would be likely to continue.

In a video with Eleanor Duncan, deputy content editor for FTAdviser, Mr Rainbow said the direction of that trend to outsource was still varied, with business going to discretionary fund managers, multi-asset, multi-managers and even to ratings agencies who are managing portfolios for advisers.

Mr Rainbow also told FTAdviser that while Brexit was "dominating a lot of conversations between advisers and their clients", he said this was not the primary concern for advisers.

He said: "What an adviser does well for their clients is keep them on the path they have set together.

"What we saw in 2016 when we had the Brexit vote and the US Presidential election, was that it would have been easy to take a knee-jerk reaction to sell a huge part of portfolios and raise a lot of cash.

"But in both cases, we have seen this would have been the wrong thing to do.

"Therefore, advisers keeping their clients on the right journey will continue to be an important part of their work in 2018 and in the years to come."

Twin fears for advisers in 2018

Brexit and ongoing regulatory activity are posing two threats to clients' portfolios over the coming year, advisers have claimed.

In the light of failed UK companies such as Carrillion struggling to compensate for the loss of large-scale contracts - which some analysts have put down to Brexit - advisers have claimed uncertainty over the terms of the UK's departure from Europe is a big concern.

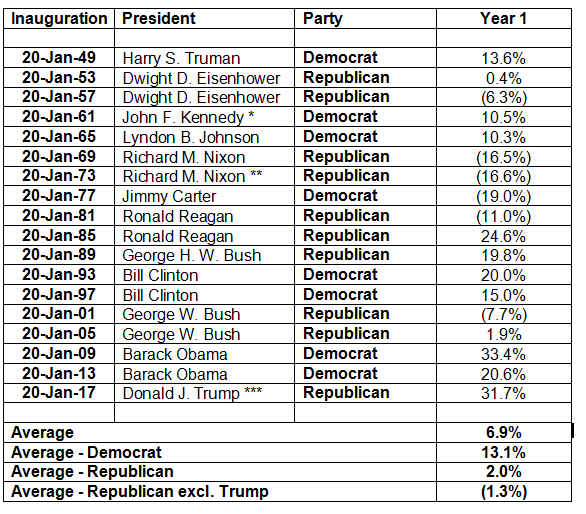

In a poll among financial advisers, 49 per cent cited Brexit as the biggest concern for 2018 and 38 per cent said ongoing regulation would pose potential problems over the course of the year.

Commenting on FTAdviser Talking Point's poll, property investment adviser Proactive Consult stated: "There are loads of regulations coming up and we have already seen many through. However, who knows which ones are in the pipeline?"

Despite concerns, some fund managers and wealth advisers believe the initial shock effects of Brexit, such as the fall in sterling and the subsequent rise in inflation, will dissipate over the course of the year.

David Hillier, portfolio manager in the multi-asset strategy group at Insight Investment, part of BNY Mellon, said: "In the UK, consumer and producer price data should show a continued decline in rates of inflation – in part as the impact of a weak pound post the Brexit decision unwinds."

Oliver Wallin, investment director at Octopus, also expressed positivity after three "key sticking-points" were resolved in terms of getting Brexit-ready.

He said: "Brexit negotiations moved on with the three key sticking points seemingly being resolved: the divorce settlement bill, rights of European Union citizens and the Irish border.

"Discussions can now move onto trade and discussions about the type of agreement the UK wants. There was talk of a transition period, which will be welcomed by business, and would take some of the time pressure off. All eyes will be on the next round of negotiations."

When a market correction comes, it will be sudden and savage as real fear returns

The concerns came as the FTSE 100 maintained its strong run, up 5.86 per cent year-on-year as of 15 January, with few signs of this abating, even given the bad news over construction companies.

Russ Mould, investment director at AJ Bell, said: "No signals look to be flashing danger – if anything all are flashing green for go.

"However, after what is now almost a nine-year bull run in UK stocks, this could be a reminder of Warren Buffett’s aphorism the right time to be fearful is when everyone is greedy and the right time to be greedy is when everyone is fearful, and right now there is little, if any, fear in evidence."

Guy Stephens, technical investment director for Rowan Dartington, said no matter what the fears: "For the time being, investors are remaining invested, mainly in equities and bonds, because there are few available alternatives.

"While there are no dark clouds with respect to earnings on the horizon, everyone is prepared to ignore the valuation concerns and keep their fingers crossed.

"When a market correction comes, it will be sudden and savage as real fear returns. Any investor who is not prepared to remain invested for the longer term and needs to crystallise value within the next couple of years should be careful indeed and consider a staggered programme of crystallisation rather than continue to ride the wave in anticipation of perfect timing.

"Arguably, the longer the bull market runs, the more savage the shock when it ends."

simoney.kyriakou@ft.com

The house view from Peter Harrison, group chief executive of Schroders

As investors look ahead to a new year, they could be forgiven for wondering whether they will be as pleasantly surprised in 2018 as they were in 2017.

A number of political worries on the horizon this time last year signally failed to materialise, including the likely shape of President Trump’s trade policies, the rise of populism in Europe and fears over North Korea.

As it turned out, the market shrugged all these aside, with both interest rates and market volatility remaining close to historic lows, while stockmarkets hit new highs.

Nearly a year on, the same worries remain, compounded by the question of how markets will react to the gradual withdrawal of quantitative easing (QE).

Investors may well ask whether these problems have been deferred or whether markets will again take them in their stride. We have gathered together the collective wisdom of our investment teams on these questions.

A number of themes emerge:

1) Valuations are stretched nearly everywhere, underpinned by low inflation and minimal interest rates. Japan stands out as one of the few attractively valued equity markets. In both Japan and Europe, stock prices should benefit from expanding profit margins which have room to catch up with other parts of the world.

2) While both inflation and interest rates should rise in 2018, few foresee them getting out of hand. However, several of our investors suggest that the market consensus is too sanguine about inflation.

The main risk we see lies in reflation, as governments turn to lower taxes and higher infrastructure spending to stimulate economies

3) One area of the equity market likely to stand out is value (cheaply-valued stocks). After the longest period of underperformance in over 40 years, the catalyst for a turnaround could be a rise in inflation and therefore interest rates.

4) Assuming policymakers can successfully juggle sustaining the recovery with controlling inflation, global bonds should not experience much downside. A keen eye will need to be kept on inflation, though.

5) In emerging markets, attractive yields for both dollar and local currency debt should be supported by continuing strong growth and relatively low inflation, alongside a stable dollar. Investors still need to beware of political developments though.

Overall, we carry a spirit of cautious optimism into 2018

In China, valuations look stretched, while growth may slow, dragged by debt reduction, particularly in the property market, and rising raw material costs, which may squeeze margins. However, domestic consumption and investment should hold firm, with selected sectors growing earnings.

6) The overall background should be good for active managers, given a likely pick-up in both volatility and dispersion (the differences between individual stock returns), alongside a fall in correlations (the extent to which stocks move together).

7) The challenges of managing businesses sustainably continue to grow, including the globalisation of policy, the increasing costs of misjudging technology and the ever-present background of climate change. Addressing them successfully will require an active approach.

If our forecasts prove accurate, GDP growth of 3.3 per cennt in 2018 will mark the strongest period for the global economy since 2011.

More important will be whether policymakers can maintain the “Goldilocks” combination of strong growth and low inflation as QE is withdrawn in the US and Europe.

The main risk we see lies in reflation, as governments turn to lower taxes and higher infrastructure spending to stimulate economies, which could lead to overheating and unexpected rises in inflation and interest rates.

Overall, we carry a spirit of cautious optimism into 2018, albeit that caution may start to overwhelm optimism as the year wears on.

It is certainly an approach we are adopting in our multi-asset portfolios, which go into 2018 with a pro-cyclical tilt in favour of equities, but with a readiness to ratchet down risk should circumstances demand it.